The insurance Industry is a vast field. Several processes and tasks need to be done repetitively. Relying completely on manual methods is not helpful at all. For this reason, IT solutions for insurance companies can help sort out the issues by automating processes.

The process of automation in insurance is providing insurers to reorganize their business globally, fast and efficient claims processing, and avoid financial and operational damages. Due to advancements in technology, new insurance terms are introduced.

Use Cases Regarding IT Solutions For Insurance Industry:

By automating the processes through IT solutions for insurance companies, the results can be generated quickly. Moreover, there will be more options to do other tasks brilliantly and efficiently. Below are the use cases that can be used in IT solutions for insurance companies:

1. Claims Processing:

If an insurance provider wants to become successful, then systematic claim processing is necessary. It is not only effective but it consumes time and labor. When it comes to manual claim processing, it will take several days and weeks. As a result, a lot of time will be consumed.

By claim processing using IT solutions, there will be more flexibility and efficiency. The automated Robotic Process Automation (RPA) insurance services can create a better customer experience. It also reduces the amount of manual work by improving accuracy. It helps in gathering and analyzing the data for commercial insurance and the cycle of policy management operations.

2. Policy management:

Since the insurance industry is wide, they are forced to implement new changes now and then. IT Solutions For Insurance Companies includes policy management and adoption automation effectively. It is a whole cycle where you have to manage the operations by using updates and policy issuance. Companies will need to go through pre-underwriting checks at the policy issuance stage. After that, an underwriting decision takes place.

With the help of Pre Built, AI use cases, and RPAs, the industry can use an automated system for policy issuance. As a result, the time and manual effort will be reduced. Even the new updated solutions can help in generating and updating the loss reports automatically. Process automation in insurance can also be used to meet business goals and then helps industries to reorganize their business processes.

What is underwriting?

Underwriting is the series of steps that are used when there is a financial risk taken by a party for a fee. This whole process needs accurate data scrambling, analyzing all facts and figures, and then risk determination. To complete this whole process takes 2-3 weeks.

To sort out the whole cycle quickly, Robotic Process Automation in insurance is taking place. In this process, all data is collected automatically and intelligent process automation helps in organizing all insurance claims timely.

3. Regulatory Compliance:

IT solutions for insurance companies are also needed to complete the regulations on time. With time, there are several modifications required. For this purpose, automation makes insurance providers organize all the business, claim systems, and insurance policies to work according to the recent industry.

The whole process of modification of business processes in internal systems is not only time taking but also risky. Even a single issue in the result and re-organizing of data can cause BIG damages to the businesses and companies can face huge losses as well. Automation using IT solutions can help the industry to regulate all processes replacing manual regulatory compliance. RPA bot validates existing customers, generates reports, and automatically updates them when needed.

4. Business Analytics using automation use cases:

The insurance industry uses a large number of paper-intensive and operational processes that take a lot of time to measure and track effectiveness. With the automation of IT solutions for insurance companies, the tasks are easily tracked by software bots. RPA can automate processes without any issues. It also helps insurers get information from multiple sources to perform many insurance operations.

Many companies can also automate insurance policies to measure the exceptions in the Insurance Industry. There is also an audit record in RPA that not only automates the process but also improves the whole process by check and balance. Due to the best automation opportunities, customer service response times and document-intensive operations are also improved effectively.

5. Effective Form Registration Using IT Solutions for Insurance Companies:

Form Registration is also another important process in the insurance industry. RPA assists through the AI-based form registration processes and verifying them. It requires only half of the total time that is required to manually fill out the forms. Machine Learning helps in data collection and the workflow of insurance industries through intelligent automation.

6. Process of Policy Cancellation within the insurance:

Policy cancellation is also a long process that involves many transactional tasks including checking the dates, policy terms, and many more. Automation in Insurance Companies using IT Solutions can be carried out in only half time. RPA in the field of Insurance allows the industry to give potential to help companies and other clients with top use cases to help in the steps taken place for processes in insurance.

What technology do insurance companies use?

Insurance companies use a variety of technologies to improve & increase the efficiency and effectiveness of their everyday operations. In this blog section, our technology experts have accumulated and discussed some of the vital technologies that insurance companies use every day in their operations, Let’s see.

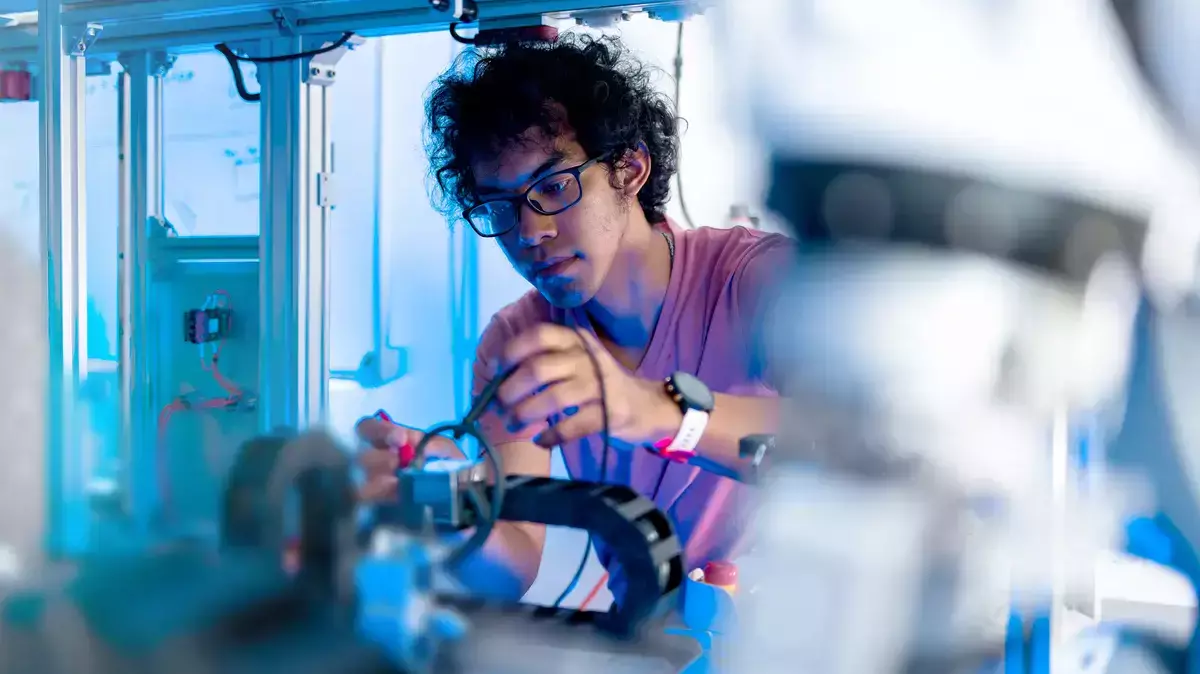

Artificial Intelligence (AI) and machine learning:

You have heard about AI, right? It’s not unknown to all that AI has tremendously changed the way we did any work previously manually. It helps to save time and increase efficiency always. These technologies are also used by insurance companies to analyze data and identify patterns that can help them better understand and predict risks. This can lead to more accurate risk assessments and more personalized insurance products.

Blockchain:

Insurance companies use blockchain technology to streamline processes and reduce the need for intermediaries, as well as to create smart contracts.

Mobile apps and wearables:

Insurance companies use these technologies to gather data on customers’ lifestyles and habits, which is used to create personalized insurance products.

Cloud computing:

Insurance companies use cloud computing to store and process data, host applications and services, and improve scalability, reliability, and security.

Internet of Things (IoT) devices:

Insurance companies use IoT devices, such as connected home devices and wearable devices, to gather data on customers’ behaviors and habits.

Data analytics:

Insurance companies use data analytics to analyze large amounts of data and identify trends and patterns that can help them better understand and predict risks.

Customer relationship management (CRM) systems:

Insurance companies use CRM systems to manage and track interactions with customers, including sales and customer service.

Robotic process automation (RPA):

Insurance companies use RPA to automate repetitive tasks, such as data entry and claims processing.

Telematics:

Insurance companies use telematics, which involves the use of sensors and other technology to gather data on driving behavior, to offer usage-based insurance products.

Predictive modeling:

Insurance companies use predictive modeling to forecast future events and outcomes based on past data and trends.

What are the Benefits of Automation of Using IT Solutions for Insurance Companies?

There are a lot of benefits of using IT Solutions for Insurance Companies including saving time, better efficiency, and reporting the issues. For more information, you can also check how insurance companies maximize efficiency with automated claims processing. Intelligent automation using rpa systems in insurance is helping many small and big companies. But there are several other benefits of insurance automation including the following:

1. Helps in Unstructured Data Processing:

There are a lot of files and a big amount of data with which insurers have to deal with on a daily basis. This whole data is carried out both manually and automatically. To sort out the processes and the data, IT solutions can help a lot. The raw facts that are gathered manually from multiple sources are time-consuming and then slow processes are carried out. The insurance industry still relies heavily upon manual systems that are quite ineffective. Here, RPA use cases can help in business processes to adapt automation programs.

AI combined with robotics can help in automating the processes at a wider scale and document the data with precision. The IT Solutions for Insurance Companies can easily help with:

- Downloading, classifying, and compiling the data using external sources

- Extraction and analysis of data using different platforms

- Automation enables Reading, sorting, and analyzing all emails

2. Customer Dealing using RPA in the Insurance Industry:

The RPA Chabot’s are helping the insurance providers to avoid scammers and time wasters and directly talk to the customers that need help. These automated chatbots analyze the customer data, use automated messaging and then sort them out in priority lists. Helps the processing of claims in the internal systems with relevant information that is more efficient for insurance providers.

3. Other Benefits of Using Automations that allow companies to transform their business:

There are several other benefits of switching to IT Solutions for Insurance Companies across your business:

- Increasing the efficiency of job functions using automation tools by 30-40 percent provided by RPA

- Achieving accuracy in legacy systems like insurance up to 80-90%

- Fast and efficient Services used to automate delivery increase up to 80%

- Amendments to these regulations due to the success of automation

Insurance companies still rely heavily upon manual filling and processes. If automation of the process takes place effectively in all steps, then the insurance industry will be better at growth.

Concluding thoughts about automation in the insurance industry:

RPA in insurance has made insurance processes work perfectly and provide business benefits. The insurance industry is believed to be efficient. For this purpose, the implementation of RPA use data can help automate the manually intensive processes. Intelligent automation solutions help companies improve regulatory processes. Many accounting firms use IT solutions like automation, CRM systems and more to obtain business growth.

Current claims systems lack functionality and cause operational damages to companies because of manual operations. Intelligent automation in insurance makes effective and better insurance policy issuance. The automated fields in the internal systems of the insurance industry help in better growth. The accuracy in growth is measured using RPA. Policymakers can change terms and conditions by using automation in the insurance industry as well. The insurance space has never been this big, but to manage it now, every company needs to adopt automation.

Frequently Asked Questions:

How is information technology useful in the insurance sector?

The use of IT involves data mining as well as quantitative analysis. There is data analytics that can be easily applied to detect any scam. The insurers can not only gather and manage data using IT but also can detect scammers. It also helps in avoiding manual mistakes to avoid any risks that can cause big losses.

How technology is changing the insurance industry?

The new and advanced technological changes in the insurance industry can allow insurers to carry out operations effectively. Risk management is easy and the use of customer data is also more secure when it comes to managing through technology. Even the “predict and prevent” features help the insurers to know what the clients need and what things are needed to avoid.

References:

- Lamberton, Chris and Brigo, Damiano and Hoy, Dave, Impact of Robotics, RPA and AI on the Insurance Industry: Challenges and Opportunities (November 29, 2017). Journal of Financial Perspectives, Vol. 4, No. 1, May 2017, Available at SSRN: https://ssrn.com/abstract=3079495

- Kajwang, B. (2022). THE ROLE AND OPPORTUNITIES OF INSURANCE IN ROBOTICS INDUSTRY. International Journal of Technology and Systems, 7(1), 89–100. https://doi.org/10.47604/ijts.1629

- Oza, Divyang and Padhiyar, Dhruv and Doshi, Viraj and Patil, Sunita, Insurance Claim Processing Using RPA Along With Chatbot (April 8, 2020). Proceedings of the 3rd International Conference on Advances in Science & Technology (ICAST) 2020, Available at SSRN: https://ssrn.com/abstract=3561871 or http://dx.doi.org/10.2139/ssrn.3561871

Get in touch with AlxTel

Need support? You are our priority, We’ve got you covered.

Rapid response time to service requests, responding to all customer feedback to get in touch.

Our goal is to supply you with the best possible customer service across all our products and solutions. We look forward to helping you make the most of your AlxTel platform.